Obama says EVERYONE MUST pay their fair share in Taxes.

To the Obama administration and the RHINOs, EVERYONE does not include those who refuse to work and leach off of those who do work.

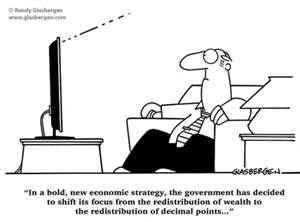

Obama says it’s about FAIRNESS. Really? What’s fair about the government stealing your hard earned money to give aide to countries that hate us, bail out big industries, or use our tax dollars so he can take lavish vacations?

Gatewaypundit – Now we find out that under the new so called bogus fiscal cliff plan, workers making less than $30,000 a year will take a bigger hit than those making $500,000 a year.

The Daily Mail reported:

Middle-class workers will take a bigger hit to their income proportionately than those earning between $200,000 and $500,000 under the new fiscal cliff deal, according to the nonpartisan Tax Policy Center.

Earners in the latter group will pay an average 1.3 percent more – or an additional $2,711 – in taxes this year, while workers making between $30,000 and $200,000 will see their paychecks shrink by as much as 1.7 percent – or up to $1,784 – the D.C.-based think tank reported.

Overall, nearly 80 percent of households will pay more money to the federal government as a result of the fiscal cliff deal.

‘The economy needs a stimulus, but under the agreement, taxes will go up in 2013 relative to 2012 – not only on high-income households, as widely discussed, but also on every working man and woman in the country, via the end of the payroll tax cut,’ said William G. Gale, co-director of the Tax Policy Center.

‘For most households, the payroll tax takes a far bigger bite than the income tax does, and the payroll tax cut therefore – as [the Congressional Budget Office] and others have shown – was a more effective stimulus than income tax cuts were, because the payroll tax cuts hit lower in the income distribution and hence were more likely to be spent,’ he added.

So what else is new?