“When the same man, or set of men, holds both the sword and the purse, there is an end of liberty.” George Mason

“When the same man, or set of men, holds both the sword and the purse, there is an end of liberty.” George Mason

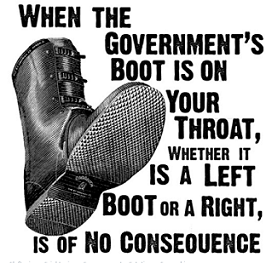

One of the greatest political philosophers, Frederic Bastiat, wrote that the law should exist to protect life, liberty, and property, but unfortunately the law is often perverted into a means of “legal plunder.” In other words, the law is used to legitimize the use of force to deprive people of their wealth. In a country founded on principles of due process and property rights, no one should be comfortable with a system that allows law enforcement agencies, both federal and state, to seize personal property without a finding of guilty or, in many cases, even leveling a criminal charge. While the Fifth and Fourteenth Amendments prohibit the governmental takings of life, liberty or property without due process of law, the government has found a way around that.

Civil Asset forfeiture is an in rem proceeding against property only and does not require formal charges of wrongdoing unlike criminal forfeiture which involves seizure of property used in criminal activity following the conviction of the owner. It is based on a fiction that property can be guilty of a crime and thereby forfeited regardless of whether any individual is ever charged or convicted of a crime related to that property. It is a fiction because inanimate objects obviously cannot think or act.

Innocent until proven guilty does not apply. The agency attempting to steal only needs to establish the basis for forfeiture by a preponderance of evidence whereas the owner of the property must prove a negative – that he did not know about its illegal use and that, if he did, he did all that he could reasonably be expected under the circumstances to terminate such use.

Civil Asset Forfeiture is used extensively by many federal agencies such as ATF, Drug Enforcement, the FBI, the Postal Inspection Service, the Marshal’s Service, the IRS, Customs and Border Protection, etc., and state agencies as a means to steal from businesses and individuals with little or no consequences. Federal and state agencies end up having a substantial budgetary stake in forfeiture because in most cases, the proceeds provide a direct funding mechanism that is totally outside of the legislative appropriations and oversight process.

In late March of 2017 the Inspectors General of the Department of Justice and Treasury Departments each released a report on the civil asset forfeiture practices of the Drug Enforcement Agency and the IRS. You can read the 72 page report at this link. What they found was that federal agencies view taxpayers as nothing more than a walking ATM. Most of the seizures for structuring violations involved legal source funds from businesses. As a result, $17.1 million was seized and forfeited to the government in 231 legal source cases, relying mostly on patterns of banking transactions to establish probably cause.

The IRS’s own internal watchdog found that they had a practice of seizing entire bank accounts based on nothing more than a pattern of under $10,000 cash deposits. They did not give the owners of the bank accounts prior notice nor did they seek to see if there might be some honest explanation for the pattern. And worse, even when the lawful owners of the funds provided an innocent explanation for their banking practices, the IRS watchdog found that the agency did not even consider whether or not it was true. In a sample of 301 investigations that resulted in property seizures, only 21 cases were identified with tax law violations.

While the Drug Enforcement Agency’s manual clearly states that seizures must be “an action that takes place incident to a major drug investigation,” the report showed that out of a 100 seizures, only 44 had advanced or were related to ongoing investigations, initiated new investigations, led to arrests, or led to prosecution. In addition, it was found that DEA agents would at times bargain with some people on how much cash to seize, while seizing all cash from others.

And it is not just the federal agencies. Under civil asset forfeiture, local and state police can and have seized cash, cars and even houses from people who ultimately are found innocent — and still pocket the proceeds. Many police departments depend on such seizures to bolster their budgets, and have fought tooth and nail to defend the practice despite the public outcry. Virginia law enforcement agencies collectively raked in more than $61 million in forfeited cash and assets from 2008 through 2014, according to the Justice Department.

And there are practically no restrictions on how forfeiture funds can be used. As Columbia, Missouri, police chief Ken Burton reminded us in 2014, “[Forfeiture funds are] kind of like pennies from heaven… It gets you a toy or something you need.” Only problem with that is that these “pennies from heaven” are forcibly taken from individuals who are often not guilty of a crime. “We just usually base it on something that would be nice to have, that we can’t get in the budget. We try not to use it for things we need to depend on,” Burton continued. If police departments truly need more funding, isn’t there more legitimate ways to increase their budget without stealing from innocent people?

“The law was originally intended as a tool to combat crime but has morphed into a veritable Godzilla, targeting not just criminals but innocent property owners. It is time to abolish the current system and reestablish a constitutionally sound process for relieving criminals of their ill-gotten gains, while protecting innocent property owners….when police can seize property with limited judicial oversight and keep it for their own use, has led to egregious and well-chronicled abuses….” Supreme Court Justice Clarence Thomas