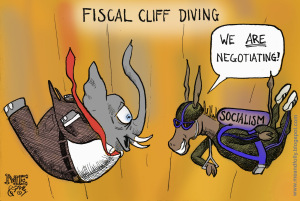

Dan Mitchell of the Cato Institute says that the backdoor negotiations on solving the fiscal cliff and reducing the deficit are irksome because our fiscal problem is excessive government spending. Red ink is merely a symptom of that underlying problem. Politicians are really talking about higher taxes in order to enable a bigger burden of government spending, not less red ink.

Dan Mitchell of the Cato Institute says that the backdoor negotiations on solving the fiscal cliff and reducing the deficit are irksome because our fiscal problem is excessive government spending. Red ink is merely a symptom of that underlying problem. Politicians are really talking about higher taxes in order to enable a bigger burden of government spending, not less red ink.

The GOP should not surrender to Obama’s tax demands as part of fight over the fiscal cliff.

There is no need for higher taxes since the budget can be balanced merely by restraining spending so that it grows 2.5 percent each year. According to the most recent Congressional Budget Office fiscal estimate, the 2001 and 2003 tax cuts can be made permanent and red ink can be wiped out in just 10 years so long as politicians simply control the growth of federal spending so that outlays don’t grow faster than 2.5 percent each year. Other nations have shown that this type of spending restraint is very successful, while no nation has ever taxed its way to fiscal success.

Since the tax increases stick and the supposed spending cuts quickly evaporate, budget deals that raise taxes have a long history of failure. Last year, in an article that was designed to browbeat Republicans for being unreasonable about tax hikes, a New York Times columnist inadvertently revealed that the only budget deal that actually led to a fiscal surplus was the 1997 agreement that lowered taxes instead of increasing them. None of the tax-hike budget deals ever resulted in a balanced budget.

America’s short-run fiscal problem is the result of too much government spending, not inadequate tax revenue. Because of large spending increases during the Bush-Obama years, the burden of federal spending has doubled in just 11 years. This is why today’s fiscal numbers look so grim. Some argue that tax revenues are below their long-run average of 18 percent of GDP, but CBO estimates show that tax collections will be above the long-run average by the end of the decade even if all the 2001 and 2003 tax cuts are made permanent. And the White House recently admitted this was true as well.

America’s long-run fiscal problem is the result of too much government spending, not inadequate tax revenue. In the absence of entitlement reform, the burden of federal spending will double, measured as a share of GDP, and the overall burden of government will exceed the levels that currently exist in every single European welfare state. Tax revenues also will climb as a share of GDP thanks to “real-bracket creep,” so there is no plausible argument that the long-run problem is inadequate revenue.

The European evidence shows that genuine spending cuts are the only effective way of solving a fiscal crisis. Nations such as Italy, Greece, France, Spain, Ireland, Portugal, and the United Kingdom have imposed massive tax increases, yet their fiscal problems remain. Indeed, in some cases, these nations are in worse shape because the tax hikes contributed to anemic economic performances. Some of these countries have belatedly begun to trim their spending burdens, but generally by relying on transitory savings rather than permanent reductions in the obligations of the welfare state. The only relative success stories on the continent are Switzerland, which never got into trouble in the first place thanks to a spending cap, and the Baltic nations, which imposed genuine spending cuts when the crisis first began and now are reaping the rewards of that fiscal discipline.

Nobody argued that there was a mandate to raise taxes before the election, when Republicans controlled the House and Democrats controlled the White House and Senate, so how can there be a mandate to raise taxes today since the election didn’t change anything?

This is not the first fiscal cliff battle. The same fight took place at the end of 2010. At the time, Democrats has an overwhelming majority in the House and even stronger control of the Senate than they do today. But by holding firm and staying united, Republicans prevailed. If they lose today, when they have far more political power, it will be a damning indictment of their incompetence.

Acquiescing to tax hikes would set a tone of weakness for 2013 and 2014, much as the 2011 “shutdown fight” needlessly gave Obama the upper hand on fiscal battles in 2011 and 2012, paving the way for subsequent defeats, such as the debt limit debacle that planted the seeds for the current tax-hike dilemma. The GOP needs to stop this carousel of capitulation. The fiscal cliff, while bad, is not as bad as a tax deal imposed on them by Obama.

If Republicans give up on taxes, they will get nothing in exchange. Integrity matters, so politicians who promised the people that they wouldn’t raise taxes should honor those commitments. A promise should mean something. And even if promises don’t mean anything to these guys, they should remember that conservatives and Repubicans in general don’t like dishonesty.

The GOP is caught between a rock and hard place, and it looks like taxpayers are going to get screwed. But Republicans do have a choice about whether their fingerprints should be on the screw.