The Democratic Communist/Socialist/Baby Killer party is hoping to buy Senior Citizens’ votes to help secure the White House in 2020.

Democratic Congressman John Larson of Connecticut has yet again introduced the Social Security 2100 Act, HR 860, a 42 page bill with over 200 Democratic cosponsors.

As yet, not one Republican has endorsed the bill and for good reason. However, before I trash it, we need to take a look at what Congressman Larson is proposing.

As like previous years, Larson’s attempt to buy Senior votes offers pretty much the same Socialist agenda of “from cradle to grave” politics. His bill offers a guaranteed 2% raise to all recipients; improves the annual cost of living adjustment (COLA) by adopting a CPE-E formula for calculating future benefits; sets benefits at 25% above the poverty line tied to wage levels to assure a minimum benefit; raises the threshold for taxation of Social Security benefits to $50,000 for an individual and $100,000 for couples, increases the maximum wage at which social security tax is collected; increase the social security tax beginning in 2020 to 7.4% which equates to an average of .50 cents per week per year to keep it solvent, gradually phased in from 2020 through 2043; as well as combine the Old Age and Survivors and Disability Insurance into the Social Security Trust Fund, which everyone knows is a trust fund in name only.

Nancy Altman, in an article at Forbes, is pushing for support of this Democratic bill. Ms. Altman claims that not only would it provide a modest increase for senior citizens already on social security, it would benefit all future retirees, assuring that all future promised benefits would be paid on time extending past the 21st century. It would also, in Ms. Altman’s mind, expand Social Security as a solution to our looming retirement income crisis and equalize our growing income and wealth inequality. She also made mention that not one Republican was on record for supporting Congressman Larson’s bill, “despite its conservative elements.” Perhaps that is with good reason.

While the bill would provide a tax cut for middle income seniors and other beneficiaries who are required to pay federal income tax on their benefits, as well as require wealthier individuals to contribute more of their hard earned income into the supposedly “trust fund,” we have to ask, at what cost?

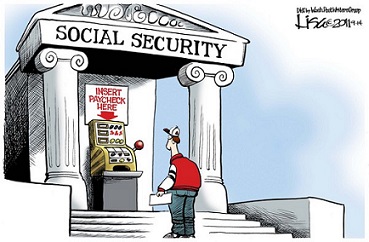

The Larson plan would gradually increase the payroll tax rate from today’s 12.4% to 14.8% by 2043, further worsening worker’s income loses. The increase would hit workers of all income levels, including the poorest among us. Needless to say, a program that reduces the wage income of an entire future generation by 4% or more will push for future increases, thereby forcing more Americans into poverty than those rescued by the changes.

Larsen’s bill would impose a new tax on higher earners, increasing SSI tax withholding to incomes up to $400,000, a figure that is not indexed but fixed which means it would capture increasing numbers of Americans over time, as has the minimum wage tax. By 2048, it is possible that no wage earnings would escape the 14.8% tax.

Social Security affects the living stands not only of beneficiaries but of all U.S. workers. It is a fact of life that the more government pushes beneficiary living standards up, the more it pushes worker living standards down. That is because the greater the benefits paid, the longer the time over which they are paid, the greater the tax contributions that must come out of worker’s paychecks. Social Security’s current benefit formula aims to have initial benefit awards grow as fast as worker earnings which in turn, causes worker standards of living, net of Social Security tax contributions, to decline relative to retiree benefits.

While there isn’t space in this article to review all the bad policy implications of the Larson bill you must be aware that it will depress savings rates, particularly among lower-income Americans; penalize long careers and induce many healthy, capable younger seniors to retire by applying an extraordinarily high marginal tax rate to their earnings, none of which is good for the country.

In addition, by basing cost of living adjustments to CPI-E, an experimental, inferior method to gauge consumer price index developed to the purchasing patterns of seniors, the government is embracing an inferior inflation measure that will depress future rate increases.

Merging social security’s disability insurance trust fund with the old Social Security Trust Fund will also overturn a longstanding bipartisan policy agreement and allow the government to divert funds from one program to the other, further endangering Social Security’s stability.

“Despite the fact that social security is a fraud in every respect, there are many who, ignoring the evidence, support it because “we must not let the old folks suffer destitution.” This implies that before 1937 it was habitual for children to cast their nonproductive parents into the gutter. There is no evidence for that, and there are no records supporting the implication that all over sixty-five regularly died of hunger….Besides, if the government did not take so much of our earnings, we would be better able to save for our later days.” ― Frank Chodorov, The Income Tax: Root of All Evil

Sources: The Larson Bill: How Fast Should Social Security Costs Grow? By Charles Blahous, the J. Fish and Lillian F. Smith Chair and Senior Research Strategist at the Mercatus Center; A Huge Step Forward in The Quest to Expand Social Security, by Nancy Altman, Forbes