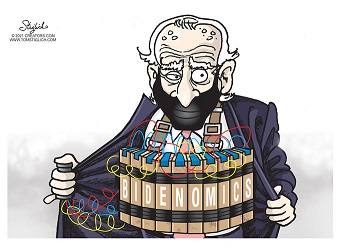

Remember Biden’s scheme to monitor everyone’s checking account because taxpayers were hiding unreported income? Apparently the peasants and their banks weren’t thrilled with the idea. Imagine that!

In rides Janet Yellen, Secretary of the Treasury, with a plan to save the day. After initially proposing to track bank accounts with more than $600, Yellen is offering a new threshold of up to $10,000 a year for money flowing into and out of your bank account before IRS “intervention.”

According to Yellen, this new proposal still reflects Biden’s belief that those at the top of the income scale who don’t pay the taxes they owe will be nailed while the peasants will be protected by the higher threshold. Oh, did I fail to mention that wage earners like teachers, firefighters and federal-program beneficiaries, are exempt.

You do realize that the new threshold represents a mere $833 in monthly outflow. The majority of mortgages are higher than that and then you still have to add in utilities, phone, cable, internet, food, clothing, etc. According to Senator Mike Crapo of Idaho, “the average American runs $61,000 through their account every year.” It doesn’t take a crystal ball to see how the peasants will be screwed.

The government is going to stick to their story that this will somehow close the so-called information gap and allow them to collect taxes on unreported income. But if the vast amount of those unpaid taxes belong to the wealthiest 1% of taxpayers, an estimate $160 billion a year, as the government claims, why not just go after the wealthy?

They could start by collecting all the delinquent taxes federal employees owe. The last report the IRS compiled on delinquent federal employees was in 2015 showing that 112,000 employees were behind on their taxes with an average debt of about $10,000. Did they collect the taxes due? We’ll never know because they haven’t compiled a report for the last 6 years. There is also the matter of a non-partisan government report indicating that Joe Biden could owe as much as $500,000 in back taxes for using a tax code loophole to avoid paying Medicare taxes for years.

Trust me; the IRS is not on your side. But neither is Nationwide, which is a story for another time.

Over the years the IRS has come to rely on automated enforcement tools to ensnare taxpayers, with the result that the lowest-earning Americans, those taking the earned income tax credit, are audited at higher rates than the richest among us. Fighting the IRS isn’t easy. And like every possible legal issue, especially if it involves the government, even when you know you’re innocent, you still have to prove it and that takes a lot of time, money and diligence. In the mean time the IRS has frozen your bank accounts and placed a lien against your property.

The IRS has admitted that it is cheaper to go after the peasants. They can save more time and more money by harassing the little guy than they can looking into the complicated holdings of someone who makes 20 times as much which explains why millionaires are 80% less likely to be audited.

Republican state attorneys general have written Biden and Yellen a letter stating that they are poised to challenge the constitutionality of allowing the government to collect data on bank accounts, regardless of the amount. “The federal government combing through almost every bank account without cause, or even suspicion is unacceptable, illegal and contrary to the constitutional principles against illegal search and seizure.”

Personally I don’t think the government will give the letter a second thought. After all, this isn’t about collecting unpaid taxes. It’s just another means to intimidate and silence the peasants.

If the government is determined to monitor our every move, we must make ourselves impossible to monitor. Kyle Sammin, Why the Biden Administration Wants to Track Your Bank Accounts, the Federalist

Source: U.S. Treasury amends proposal to track nearly all bank accounts by Irina Ivanova, CBS News; State AGs warn of challenge if Biden bank data collection passes by Fred Lucas, Fox Business; I’ll Be Watching You, Franklin County Patriots; Joe Biden could owe up to $500,000 in back taxes to the IRS by Washington Post; The IRS Admits It Doesn’t Audit the Rich Because It’s Too Hard by Luke Darby, gq.com