“There are two ways to enslave a nation. One is by the sword. The other is by debt.” John Adams

“There are two ways to enslave a nation. One is by the sword. The other is by debt.” John Adams

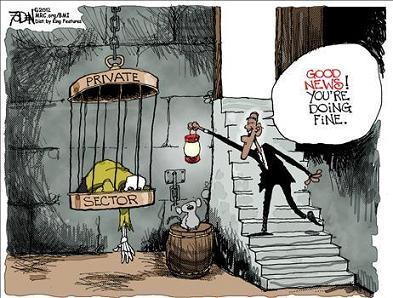

We’ve all heard the glorious proclamations that the economy has turned thanks to the fed, everything is right with the world. The truth is, the Fed has mastered the art of messing up the economy, and it doesn’t have the ability to stop the bad consequences of its own manipulative actions.

Despite what the lap-dog media feeds you, and despite the cheery messages coming from the White House, the economy is not out of danger. Both the U.S. economy and the world’s economy are in the tank. Cyprus should be a wake-up call.

Bernanke has created trillions of dollars out of thin air and dumped it into the financial system hoping to stimulate the economy. What quantitative easing are we into now? So far it has been a bust but never fear, Bernanke said he would keep trying until the Fed gets it right.

David McAlvany, CEO of McAlvany Financial says that Ben Bernanke has “done virtually nothing in terms of stimulating the economy. He’s done a tremendous amount to stimulate asset prices, and you see that reflected in many of the world stock markets, particularly ours. But the U.S. market is trading on the basis of the Fed’s stimulus, not of the economy and earnings. If you do a sampling of CEOs across the country you will find a very dark picture.

If you look at insider selling, it’s been very aggressive for the last six to nine months, indicating that insiders in corporate America don’t see a bright tomorrow. So what is driving asset prices? It is cheap money from the Fed. Funny money can take prices considerably higher, but you are at this point playing a greater fool theory where you buy into today’s prices,” where you’re essentially hoping someone steps in to bail you out from a fundamentally unsound trade at considerably higher prices.

The Cyprus bailout, which involves losses for bank depositors, puts the safety of deposits open to question anywhere in the world. The banking catastrophe in Cyprus could be repeated in the United States and elsewhere according to Marc Faber, editor and publisher of the Gloom Boom & Doom report.

“It can happen anywhere in the world, in Western democracies, because you have more people who vote for a living than people who work for a living.

Therefore, the wealthy in the United States should “be prepared to lose 20 to 30 percent. I think you’re lucky if you don’t lose your life,” he noted.

Despite equity markets reaching all-time highs, Faber says he is “very cautious” about the U.S. market. “What concerns me really is that most foreign markets have performed very badly since January, . .the U.S. is the only game in town. Each time there was only one game in town – it ended badly. I am very cautious about the U.S. market. We could very well first rise and then a crash from summer onward. We have this money printing, which obviously will lead to misallocation of capital. The majority of people don’t own meaningful stock positions and they don’t benefit from a rise in the stock market. But they are being hurt by rising costs of living and we all know that the real income of the median household is going down for the last few years.”

Jason Trennert of Strategas Research Partners calls “the only game in town” the “TINA” (there is no alternative) factor. There are no absolutes when you are talking about the complexities of world economies and the dynamics of the securities markets. “You are better served by focusing on what factors could unravel. . .In my opinion Europe continues to be the Achilles’ heel of the bull market. I find the events coming out of Cyprus and the European Union. . .to be of a particular concern. Many of the stock market corrections we faced in the last few years originated from Europe.”

I got out of the stock market a few years ago after waking up one morning to find my net worth was almost 40% less than it had been when I went to bed. I waited it out until the market had climbed sufficiently and then sold all my stock. Thinking my money, while earning less, would be more secure, I put it in the bank and I might add, until Bernanke drove interest rates down, I was doing fine. Now I don’t even have that security. I thought of just taking the money out of the bank and burying it in my backyard – at least the government couldn’t get their hands on it. But then, if the country goes bankrupt, that money wouldn’t be worth the paper it was printed on anyway. A friend told me that if I was going to be that ‘paranoid’ I should buy gold and silver. Really?

In 1933–34, amid the depths of the Great Depression, the U.S. government seized the American people’s gold holdings. Until 1975, it was illegal for Americans to own gold, other than in some forms of jewelry or collectors’ coins. In the panic of the Depression years the courts upheld this unconstitutional confiscation. Yes, people received dollars in return for their gold but the dollar itself was formally devalued by 40%. Moreover, the U.S. government abrogated private commercial contracts containing the so-called gold clause, which allowed creditors to receive payments in either dollars or gold. It could easily happen again.

There have been rumblings from some revenue-hungry Democrats about finding ways to steal individuals’ retirement accounts. Several years ago Argentina nationalized the private pension plans of its populace. Holders of Roth IRAs may also be in for a rude shock. Their contributions have been made with after tax dollars, with the promise that the ensuing benefits would be exempt from federal income tax. Slapping a special “emergency” levy on these assets will become an irresistible temptation for politicians as the pot of assets gets bigger.

Money market funds? There’s growing regulatory pressure for the funds to no longer price their products at $1 a share. In today’s distrustful environment fluctuations here will fuel fears. Moreover, the feds may well be tempted to take some of this cash as “temporary” reserves, or insurance fees.

The sobering truth is that there is no safe hiding place to stash your cash, gold or silver other than stuffing ’em under your mattress (and pray that the boxes or bags in which you store the cash can withstand the assaults of rats or mice). But there are ways for the government even to steal that!

The Federal Reserve has already stated that it wants to get inflation up to 2.5%. Put aside for the moment the impossibility of concocting a true price index—the Consumer Price Index, for example, allocates less than 1% of the cost of living to health insurance! Inflation, as John Maynard Keynes wrote nine decades ago, is a form of taxation—and, in this case, taxation without representation. Especially invidious is the fact that inflation hits lower-income earners disproportionately hard, as they spend a higher percentage of their income on fuel, electricity and other necessities.

Congress might also be tempted to propose something that has surfaced all too often in Europe – a wealth tax. In France, for instance, you tote up the value each year of everything you own and pay the government a 1% tax on the amount above a certain threshold. We have something of a precedent for that here, its called your local property taxes. A wealth tax would simply be an expanded form of that levy.

“They tax when you earn a dollar, they tax you when you save it, they tax you when you invest it. If you earn a dividend, they tax it again, and if you’re stupid enough to die, they steal up to half.” Grover Norquist, Americans for Tax Reform

1 comment for “Cyprus and The Fed’s Funny Money”