As part of his 2014 proposed budget, Obama is proposing to use a new measure of inflation, the Chained Consumer Price Index, which would show a lower level of inflation than the more widely used Consumer Price Index. The chained CPI assumes that as prices rise, consumers turn to lower-cost alternatives, reducing the amount of inflation they experience. For example, if the price of beef increases while the price of pork does not, people will buy more pork rather than pay the higher beef prices.

As part of his 2014 proposed budget, Obama is proposing to use a new measure of inflation, the Chained Consumer Price Index, which would show a lower level of inflation than the more widely used Consumer Price Index. The chained CPI assumes that as prices rise, consumers turn to lower-cost alternatives, reducing the amount of inflation they experience. For example, if the price of beef increases while the price of pork does not, people will buy more pork rather than pay the higher beef prices.

If adopted the new inflation measure would have far-reaching effects since so many programs are adjusted each year based on year-to-year changes in consumer prices.

Social Security recipients would get smaller benefit increases each year. The federal poverty level would rise by smaller amounts, meaning more people would technically rise out of poverty with only small increases in income. Taxes would go up because of smaller adjustments to income tax brackets, the standard deduction and the personal exemption amount. According to Congressional estimates , the change would reduce the federal budget deficit by a total of $340 billion over the next decade.

The chained CPI is popular among budget hawks in part because it cuts benefits and increases taxes gradually, in ways that might not be readily apparent to most Americans. Those in favor of the change claim that the current system used to measure inflation is flawed because it doesn’t reflect reality. But then, of course, neither does the chained CPI.

Chained CPI is just another in a long line of government statistical scams. According to Walter J. Williams, an expert on how the federal government lies with statistics, “changes made in CPI methodology during the Clinton Administration understated inflation significantly, and, through a cumulative effect with earlier changes that began in the late Carter and early Reagan Administrations, have reduced current social security payments by roughly half from where they would have been otherwise.”

Once the CPI was fully phased in, Social Security benefits for a typical middle-income 65-year-old would be about $136 less a year, according to an analysis of Social Security data. At age 75, annual benefits under the new index would be $560 less. At 85, the cut would be $984 a year.

The tax increases would start off small, too, but would add up to $142 billion over the next decade. After 10 years, taxpayers making between $10,000 and $20,000 would see a 14.5 percent increase in their federal taxes with a chained CPI, according to a 2011 analysis. Those making between $30,000 and $40,000 would see a 1.4 percent increase while taxpayers making more than $1 million would get a tax increase of 0.1 percent.

It is easy to see that seniors, the disabled and low-income families would not only see their income level drop but would also see the greatest tax increase, because much of their income is not currently subject to the federal income tax. Smaller annual adjustments to the tax brackets would push more of their income into the 10 percent tax bracket.

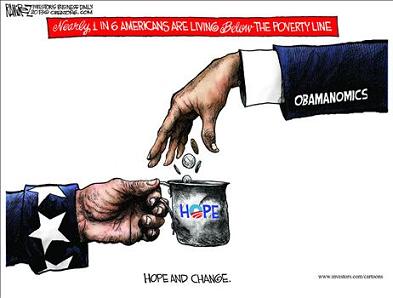

It is just another example of how Socialist policies screw the little guy.