“The typical American voter is so stupid, his dog teaches him tricks.” –Jonathan Gruber architect of Romney-Obama-Care

The hot topic again this week coming from today’s conservatives is an attempt to get you caught up into a debate about what is illegal. The GOP is attempting to appease the American voter with a change of name again to implement the illegal and unconstitutional “Obamacare” (Mark 8:15).

Look at this word play here America. First, it was the “RomneyCare.” Then, it became the “Affordable Care Act.” Now it is the “American Health Care Act.” No matter what it is called, or who the president is who pushes for it and signs it, it is illegal (Psalm 94:20).

Rather than getting caught up into the debate that they want you to get caught up into, the question that should be presented to them who call themselves representatives is, “Where are you deriving your authority from to implement these unconstitutional acts?” It is a question that they simply cannot answer.

In other words, “If they can get you asking the wrong questions, they do not have to worry about giving you the right answers.”

Considering that which you have been led to believe concerning Romney-Obama-care and that it is such a good deal (Premiums are skyrocketing) for Americans, why does it not apply to the Congress that approved these unlawful measures?

“Exploiting the stupidity of the American voter is fun and easy: kinda like squeezing a lemon.” –Jonathan Gruber architect of Romney-Obama-care

“Lack of transparency is a huge political advantage. Call it the stupidity of the American voter or whatever, but basically, that was really, really critical for the thing to pass.” -Jonathan Gruber architect of Romney-Obama–care

“When we’re done with employer-based health insurance, it will have s much life in it as Jimmy Hoffa.” -Jonathan Gruber architect of Romney-Obama-care

P.T. Barnum said a sucker is born every minute, but his estimate was laughably low. -Jonathan Gruber architect of Romney-Obama-care

WorldNet Daily reported on how Obamacare threatens to shred the Constitution.

Here are the top six legal arguments cited in “Impeachable Offenses” challenging the legality of Obamacare.

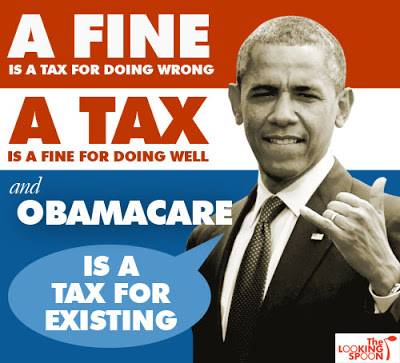

1. Taxation without representation

The law appears to violate Article 1 Section 9 of the Constitution, which stipulates: “No capitation, or other direct, Tax shall be laid, unless in Proportion to the Census or Enumeration herein before directed to be taken.”

The section is clarified in the 16th Amendment: “The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.”

The Supreme Court ruled the law’s individual mandate requiring most Americans to obtain health insurance is a tax. However, according to experts cited in “Impeachable Offenses,” the mandate does not fit the description of any of the three types of valid constitutional taxes – income, excise or direct.

Write Klein and Elliott: “Because the penalty is not assessed on income, it is not a valid income tax. Because the penalty is not assessed uniformly or proportionately, and is triggered by economic inactivity, it is not a valid excise tax. Finally, because ObamaCare fails to apportion the tax among the states by population, it is not a valid direct tax.”

Despite Obama’s public statements that the individual mandate was not a tax, the Supreme Court ruled June 28, 2012, in a 5 to 4 vote, with conservative Chief Justice John Roberts siding with the majority, that the requirement that the majority of Americans obtain health insurance or pay a penalty was constitutional, authorized by Congress’s power to levy taxes.

“The Affordable Care Act’s requirement that certain individuals pay a financial penalty for not obtaining health insurance may reasonably be characterized as a tax,” Roberts wrote in the majority opinion. “Because the Constitution permits such a tax, it is not our role to forbid it, or to pass upon its wisdom or fairness.”

In a second 5 to 4 vote, again with Justice Roberts joining the majority, the court rejected the administration’s most vigorous argument in support of the law, that Congress held the power to regulate interstate commerce.

The Commerce Clause, the court ruled, did not apply.

However, Klein and Elliott document the White House has been changing the law without involving Congress since the Supreme Court ruling and that multiple sections of the implementation of Obamacare are unconstitutional.

2. Illegally bypassing Congress? Bribing states?

“Impeachable Offenses” cites Jonathan H. Adler of the Case Western Reserve University School of Law and Michael F. Cannon of the Cato Institute.

The duo found: “The law encourages states to create health-insurance exchanges, but it permits Washington to create them if states decline. … ObamaCare authorizes premium assistance in state-run exchanges (Section 1311) but not federal ones (Section 1321).

“In other words, states that refuse to create an exchange can block much of ObamaCare’s spending and practically force Congress to reopen the law for revisions.”

The Obama administration, however, was furiously at work in an attempt to avoid a legislative debacle. The administration proposed an IRS rule to “offer premium assistance in all exchanges ‘whether established under section 1311 or 1321,’” Adler and Cannon said.

The Treasury Department, they continued, was “confident” that the IRS had the authority to offer premium assistance where Congress had not authorized it and that this overreach was “consistent with the intent of the law and [its] ability to interpret and implement it.”

“Such confidence is misplaced,” Adler and Cannon asserted. “The text of the law is perfectly clear. And without congressional authorization, the IRS lacks the power to dispense tax credits or spend money.”

In May 2012, the IRS released its final regulations that would “provide guidance to individuals who enroll in qualified health plans through Affordable Insurance Exchanges and claim the premium tax credit, and to Exchanges that make qualified health plans available to individuals and employers.”

Free-market advocate Phil Kerpen, cited in “Impeachable Offenses,” called the regulations an “outrageous edict that attempts to up-end the ability of states to opt out of [Obama’s] health care law’s new entitlement.”

Kerpen called the Obama administration out for what he said was an obvious attempt to “bribe states to participate by manipulating language in the law that is meant to authorize start-up grants to instead fund years of operating expenses.”

Indeed, a July 2012 announcement from the Department of Health and Human Services offered states six full years of funding.

Was the maneuver constitutional? Article I, Section 1 states: “All legislative Powers herein granted shall be vested in a Congress of the United States, which shall consist of a Senate and House of Representatives.”

Congress does not vest the power to write and rewrite laws in HHS and IRS; nor can unelected bureaucrats impose taxes on states that legitimately opted out of a federal program, Kerpen continued.

“Impeachable Offenses” further cites Adler and Cannon on how the IRS went ahead in May 2012 and finalized “a rule that will issue tax credits – and therefore will trigger cost-sharing subsidies and employer-mandate penalties – through federal Exchanges.”

They contended that the rule is not only illegal, but it also lacks any statutory authority.

3. ‘State’s rights violated’

The 10th Amendment to the Constitution reads: “The powers not delegated to the United States by the Constitution, nor prohibited by it to the States, are reserved to the States respectively, or to the people.”

The Tenth Amendment Center, which was among the plaintiffs that took Obamacare to the Supreme Court, clarifies that the amendment was “written to emphasize the limited nature of the powers delegated to the federal government.”

“In delegating just specific powers to the federal government, the states and the people, with some small exceptions, were free to continue exercising their sovereign powers.”

As of February 2013, only 17 states and the District of Columbia planned to run their own exchanges, while another seven opted for state-federal exchanges. The 26 states that have chosen to opt out entirely challenged the law in the Supreme Court

In January 2010, Ken Klukowski explained that the 10th Amendment does not apply here in the way many people have thought – although it does apply in a more serious manner, “Impeachable Offenses” relates. Klukowski co-authored with former Ohio Secretary of State Kenneth Blackwell the 2010 book “The Blueprint: Obama’s Plan to Subvert the Constitution and Build an Imperial Presidency.”

Citing two cases from the 1990s, Klukowski wrote that the Supreme Court “shocked the legal world” by striking the cases down for violating the 10th Amendment.

The first case was in 1992, New York v. United States, in which “the Court struck down a federal law requiring states to pass state laws for the disposal of radioactive waste, and to issue regulations for implementing those laws.”

In the second case, Printz v. United States in 1997, the court “struck down a provision of the Brady Act – a federal gun-control law – that required state and local law enforcement to run background checks on handgun purchasers.”

From these two cases, Klukowski explained, “emerged the anti-commandeering principle, holding that the 10th Amendment forbids the federal government from commandeering – or ordering – any branch of state government to do anything. The states are sovereign and answer only to their voters, not to Washington, D.C.”

The commandeering principle is the real problem for Obamacare, write Klein and Elliott, since the law requires each state to set up an insurance exchange.

“It then requires the states to pass regulations for implementing those laws. And it further requires the states to dedicate staff and spend state money to administer those programs,” said Klukowski.

In his opinion, Obamacare is a “straight-out repeat of those 1992 and 1997 cases.”

“The main difference is that Obamacare violates the anti-commandeering principle in a far more severe and egregious way than those previous laws ever did,” Klukowski concluded.

4. Originated in Senate?

“Impeachable Offenses” cites Article 1, Section 7 of the Constitution, which states: “All bills for raising Revenue shall originate in the House of Representatives.”

The Sacramento, Calif.-based Pacific Legal Foundation filed a challenge to Obamacare that contends it is unconstitutional, because the bill originated in the Senate, not the House.

The foundation claims that under the Origination Clause of the Constitution “all bills raising revenue must begin in the House.”

The tip to follow this course of action came from the Supreme Court itself. In his June 28, 2012, ruling, Chief Justice Roberts took pains in the majority opinion to define Obamacare as a federal tax, not a mandate.

The Justice Department claimed that the bill did not originate as a spending bill and therefore does not violate the Origination Clause.

The bill, which began life as House Resolution 3590, then called the Service Members Home Ownership Act, was stripped of its contents after it passed in the House in a process known as “gut and amend.” The legislation was replaced entirely with the thousands of pages of what eventually became Obamacare and given a new name.

The Obama government’s position is that while using the resolution as a “‘shell bill’ may be inelegant … it’s not unconstitutional.”

The foundation’s response, as documented in “Impeachable Offenses,” was that “it is undisputed that H.R. 3590 was not originally a bill for raising revenue. … Unlike in the prior cases [cited by the Justice Department], the Senate’s gut-and-amend procedure made H.R. 3590 for the first time into a bill for raising revenue. The precedents the government cites are therefore inapplicable.”

While the Justice Department contended that raising revenue was incidental to Obamacare’s “central purpose” – to improve the nation’s health care system – the foundation’s attorney, Timothy Sandefur, disagreed.

“What kinds of taxes are not for raising revenue?” he asked.

5. Creating commerce

The Commerce Clause, as stated in Article 1, Section 8 of the Constitution, grants Congress the right to regulate interstate commerce, not intrastate commerce, Klein and Elliott note.

Since the 1930s, Supreme Court decisions have interpreted the Commerce Clause broadly,” writes Ilya Somin, an associate professor of law at George Mason University School of Law and co-editor of the Supreme Court Economic Review.

“But every previous case expanding the commerce power involved some sort of ‘economic activity,’ such as operating a business or consuming a product. Failure to purchase health insurance is neither commerce nor an interstate activity. Indeed, it is the absence of commerce,” Somin added.

Georgetown University Law Center professor Randy Barnett, a former student of Harvard Law School professors Charles Fried and Laurence Tribe, “both of whom argued for the constitutionality of the [economic] mandate,” writes Klein and Elliott, has been referred to as “the ‘mastermind’ of the legal challenge” against ObamaCare.

Barnett opined in a March 2011 debate with his former teachers: “Though Congress can compel people to be drafted into the military or sit on a jury, those activities relate to, as the Supreme Court put it, the ‘supreme and noble duty’ of citizenship . . . There is no supreme and noble duty of citizens to enter into contracts with private companies.”

Barnett added that “the mandate would result in a ‘fundamental alteration in the status of American citizens.’”

Even the Congressional Budget Office weighed in, stating in January 2010: “A mandate requiring all individuals to purchase health insurance would be an unprecedented form of federal action. The government has never required people to buy any good or service as a condition of lawful residence in the United States.”

6. Illegal penalty?

Obamacare affixes a financial penalty on Americans who fail to purchase health insurance in order to regulate behavior – regulatory powers not granted in the Constitution, documents “Impeachable Offenses.”

Scott P. Richert commented after the Supreme Court ruling: “Congress has been given the green light to do something that even the most imaginative interpretation of the Commerce Clause would not allow: to compel the supposedly free citizens of the United States to purchase anything that Congress deems in those citizens’ best interest – or to compel them to purchase one thing rather than another.”

Richert, who is executive editor of Chronicles, the monthly magazine published by the conservative think tank the Rockford Institute, continued: “All Congress has to do is to pass legislation levying a tax on those who, say, fail to purchase smoke detectors for their homes, or who insist on purchasing a car that runs on gasoline over one that runs on electricity.”