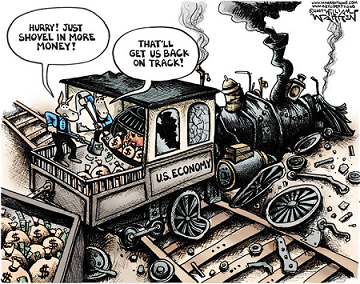

With its $700 billion bond-buying expansion in response to the COVID crisis, the Fed, like a sixteen-year-old with a credit card, is salivating over what money creating powers it will seize next.

The Fed, which has already pushed interest rates to zero and expanded into “unlimited” buying of assets, is now reaching to corporate bonds and local government bonds. Joy! In addition to destroying retirement savings they are now willing to cover the losses for corporate and government irresponsibility.

And what they are proposing is bonkers! Negative interest rates – directly subsidizing bonds – writing checks for corporate equity – a universal basic income up to $72,000 – letting poor countries effectively print their own US dollars. What could possibly go wrong?

Negative rates would need compulsory rules such as declaring worthless all serial numbers ending in zero, or forcing Americans to use “crypto” dollars that automatically devalue. Subsidizing bonds by targeting interest rates would permanently suck capital from the private sector into unlimited local government spending. Buying corporate equity risks turning every business in America into a government-run entity, a road Japan is building. Printing $72,000 per family per year, or letting Guatemala print US dollars at will, is the kind of thing one expects from crash-the-dollar Bitcoiners, not from businesses, Congress or central bankers.

The common thread of all these proposals is to triple down on unlimited creation of money from thin air to subsidize big business and governments, the price of which will be paid by those unwise enough to either not work for the government or to not have a good lobbyist – in other words, the peasants.

The joy of all this government generosity will be immediate but the pain will stretch over decades. Beyond inflation, this level of spending risks permanent distortions in capital markets—a permanent siphon of trillions from the private sectors and individuals to the government and politically favored sectors. All that new money artificially props up prices, and the longer they remain propped up, the longer capital flows towards the prop. Even after the crisis, no politician, much less Trump, will want to be the guy who takes away the punch bowl.

And this is already becoming a supersized punch bowl. We can only imagine the pressure to keep propping, say, local government borrowers, again becoming a permanent siphon on the productive economy.

Historically pandemics have a limited impact on long-term growth. While there is an immediate hit to wealth, the fundamental workings of an economy are not normally affected by a pandemic any more than by an earthquake or bad winter. After all, as Austrian theory emphasizes, an economy is made of entrepreneurs forever seeking new desires to satisfy.

That said, what can affect the fundamental workings of an economy is radical policies that impose new burdens on producers, whether in the form of new regulations or new taxes to pay for the handouts.

We can see the difference in America’s last two pandemics, in 1957 and 1968. When policy was prudent, in 1957, recovery was very fast. When policy was interventionist, as in 1968, the pain lasted for a generation, through the 1970s and into the 1980s.

As for inflation, Austrian models of money demand suggest little risk during the recession itself, as excess money is saved, but a raised risk if we do get that V-shaped recovery and cash savings are spent. And, of course, stagflation becomes a real possibility if the government follows the 1970s playbook of economy-wrecking reforms while pumping out all that fresh cash out of thin air.

It’s still possible for us to get out of this relatively economically intact, but only if we cut the legs out from under the empire-builders in Washington NOW.

Source: The Fed Has Gone Nuts. And It Can Get Worse by Peter St. Onge, Mises Institute; Nothing is out of the question’: What it would take for the Fed to start buying stocks, by Jeff Cox; 6 things the Federal Reserve can still do to fight the recession by Dylan Matthews, Vox; Press Release: Waters Announces Committee Plan for Comprehensive Fiscal Stimulus and Public Policy Response to Coronavirus Pandemic; Fed announces unlimited QE and sets up several new lending programs by Greg Robb, Market Watch