No amount of money can replace the moral problems that plague society. John Horvat II

Biden, working on the so-called American Families Plan is facing pressure from Pelosi and Bernie Sanders over whether to use the plan to strengthen ObamaCare or expand Medicare eligibility. Pelosi wants to make permanent ObamaCare subsidies included in the stimulus package and Bernie wants to lower the age of eligibility and add more benefits to Medicare, a program that the government claims will be bankrupt in a matter of years.

As the plan currently stands, Biden has determined that it will provide at least four years of “free” education beginning with preschool and ending with two years of “free” community college. In addition, Biden wants to provide direct support to low and middle income families to ensure that they spend no more than 7% of their income on child care; create paid family and medical leave; extend the Child Tax credit, the Earned Income Tax Credit, the Dependent Care Tax Credit and expand the Health Insurance tax credit, etc. all at the low- low price of $2 Trillion dollars, which Biden claims can be recouped with higher taxes on corporations and those greedy rich people.

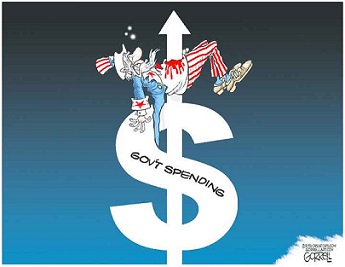

When you add up the cost of the infrastructure, stimulus and family plan the left is trying to pass, you are looking at putting taxpayers on the hook for an additional $8 trillion plus. And we all know that not one government program has ever come in on or below the estimated costs because of waste and fraud, not to mention Congress constantly adding new measures with ever increasing costs.

To help pay for all these socialist goodies, Biden’s plan includes some significant tax law changes. Most will affect business (that will pass the costs along to consumers) and those greedy rich people. However, the deferred sale on real estate will directly affect homeowners across the board by limiting the amount of gain on the sale of your home that can be deferred in a like-kind exchange. In addition, changes to the inheritance tax (death tax) laws and Net Investment Income tax laws could also result in additional taxes for middle income families. Of course, it never matters who initially pays the tax, eventually it trickles down to the peasants.

The left holds the absurd belief that any problem can be resolved if enough money is thrown at it. Unfortunately, money will not solve the moral problems that ail today’s families. But then, showering money on people who don’t necessarily need it is a feature of the left’s agenda. The point is to build a new system that includes everyone, from which there is no escape, and increasing the power of the ruling elite.

True freedom is preserved in the home. In his book What’s Wrong With the World, G. K. Chesterton, writes: The home is the one anarchist institution … it is older than law, and stands outside the State … By its nature it is refreshed or corrupted by indefinable forces of custom or kinship. This is not to be understood as meaning that the State has no authority over families; that State authority is invoked and ought to be invoked in many abnormal cases. But in most normal cases of family joys and sorrows, the State has no mode of entry. It is not so much that the law should not interfere, as that the law cannot.

Source: The US debt limit constrains nothing but honesty by Ramesh Ponnuru, Bloomberg; Additional Guidance Issued for President Biden’s American Jobs and American Families Plan, National Law Review; Biden’s ‘American Families Plan’ leaves out the family by John Horvat II, Life Site; Why Biden’s ‘American Families Plan’ Is Anti-Family At Its Core, by Grayson Quay, The Federalist