Welcome to Socialized Health Care!

Stephen Moore, Sr. Economics writer for the Wall Street Journal says that 75% of ObamaCare taxes will fall on the backs of those Americans making less than $120,000 a year.

Taxes that went into effect in 2010:

Taxes that went into effect in 2010:

1) Excise Tax on Charitable Hospitals – $50,000 per hospital if they fail to meet new “community health assessment needs, financial assistance, and billing and collection” rules set by HHS. This tax will be passed to consumes.

2) Codification of the economic substance doctrine – Tax hike of $4.5 billion. This provision allows the IRS to disallow completely, legal tax deductions and other legal tax minimizing plans just because the IRS deems that the deduction lacks “substance” and is merely intended to reduce taxes owed. Isn’t that what deductions are for – to reduce our tax burden?

3) Black Liquor Tax – $23.6 billion – This tax actually has nothing to do with health care. It is a tax on a type of bio-fuel but it will be added to the cost of your insurance and medical care.

4) Tax on Innovator Drug Companies- $22.2 billion. This is an annual tax on the industry imposed relative to share of sales during any given year. This will also be passed along to consumes in the form of higher perscription costs.

5) Tax on indoor Tanning Services – $2.7 billion. 10% excise tax you pay every time you want into an in an indoor tanning salon.

Taxes that took effect in 2011:

1) Medicine Cabinet Tax. Americans can no longer use your health savings account (HSA), your flexible spending account (FSA), or heath reimbursement (HRA) pre-tax dollars to purchase non-prescription, over-the-counter medicines, except insulin.

2) HSA Withdrawal Tax Hike. Inceased tax on non-medical early withdrawals from 10% to 20%.

Taxes that took effect in 2012:

1) Employer Reporting of Insurance on W-2. This is a preamble to taxing health benefits on individual tax returns.

Taxes that will take effectin 2013:

1) Medicare Payroll Tax Hike. On the first $250,000, the tax increases to 2.35%. While this tax may not seem like a lot to those making under $250,000, it hurts small businesses were every penny counts.

2) Tax on Medical Device Manufactrers. This tax of 2.% for Medical device manufacturers will be passed to the consumers who can least afford it – the elderly, the disabled.

3) Medical Itemized Deduction – This increases from 7.5% to 10% of your adjusted gross income on everyone. It amounts to a 2.5% increase in your income taxes. This new tax is waived for 65 plus taxpayers in 2013 through 2016 only.

4) Flexible Spending Account – imposes a cap of $2500.00 indexed to inflation after 2013. One group of FSA owners – those with special needs children – will be hit the hardest by thisnew cap.

5) Elimination of tax deducton for employer provided retirement drug coverage.

Taxes that take effect in 2014:

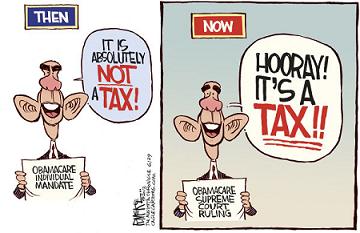

1) Individual Mandate Excise Tax – anyone not buying “qualifying” (government approved) health insurance must pay an income surtax starting in 2014 of 1% of their adjusted gross income. This goes up to 2% in 2015 and 2.5% in 2016. The only exemptions are for illegal immigrants, prisoners and those earning less than the poverty line, American Indians and hardship cases, determined by HHS.

2) Tax on Health Insurers. This annual tax is paid based on health insurance premiums collected during the year. Phases in gradually until 2018 and is fully imposed on firms with $50 million in profits. All these costs will be past to policy holders.

3) Excise tax on Comprehensive Health Insurance Plans. Starting in 2018, the 40% excise tax on ‘cadillac’ health insurance plans – $10,200 for singles and $27,500 on families. As health costs continue to spiral under ObamaCare more and more middle income families will face his tax.

Obamacare can’t be repealed because one in seven Blacks, one in ten Hispanics and one in twelve Italians (thanks Fumento) have HIV/AIDS and can’t afford healthcare.

Dear Ano nymous: These people have been getting medical care through Free Clinics and Medicaid through their states. Obviously you are not aware of what socialized medicine entails. In the UK, they are allowing premature babies and the elderly to die to save money. How long do you think it will be before that comes to America. ObamaCare is not financially feasible.